We don’t have to tell you about the importance of compliance, but it’s a drum we beat all the time here at Fleetio. In the past, we have talked a lot about FMCSA compliance regulations and how Fleetio Inspections helps you tighten up your process. Today, we wanted to briefly talk about fuel compliance—particularly International Fuel Tax Agreement (IFTA) compliance.

What is IFTA?

In simple terms, The International Fuel Tax Agreement is between the lower 48 states of the United States and the Canadian provinces. When this agreement was established in 1986, the goal was to create a simplified approach to reporting fuel usage for fleets that operate in multiple jurisdictions.

What happened prior to IFTA?

Prior to the 1986 IFTA agreement, fleets were required to meet fuel licensing and tax requirements for every state where they did business. For larger fleets, this could have included up to 58 individual jurisdiction licenses. In fact, each U.S. state had it’s own fuel licensing and tax system, which became overwhelmingly cumbersome for many fleets aiming to streamline their fuel compliance processes.

How IFTA works

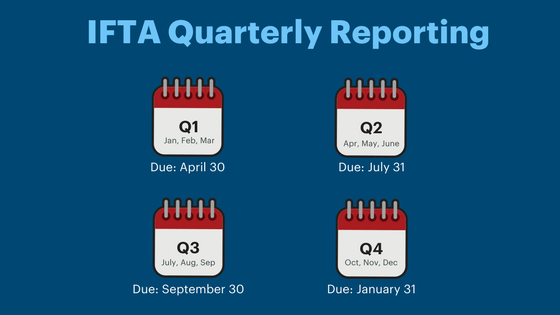

A fleet operating in multiple jurisdictions applies for an IFTA license. Upon approval of that application, your fleet receives the IFTA license along with two decals for each qualifying fleet vehicle. From here, you are required to file a quarterly fuel tax report. Officials use this report to determine the net tax or refund due to your fleet. From here taxes are redistributed to the appropriate jurisdiction. This eliminates the need to file with every single state individually. IFTA allows fleets to simply file fuel tax reports with the one state where they procure their IFTA license.

Why IFTA matters for your fleet

While IFTA is a huge leap from where we were just a few decades ago, administrating fuel tax reports is incredibly cumbersome. In fact, IFTA regulations require that fleets accurately track Individual Mileage Reports (IMVRs) and fuel reports. Then fleets are required to consolidate to, reconcile and report on within 30 days from the end of each quarter.

Simply filing these reports is a cumbersome task for any fleet. Fleet managers often create these reports manually. This means spending countless hours gathering and interpreting handwritten IMVRs and reviewing paper receipts. In the case of some fleets, there are 2 to 3 people whose sole job junction is processing IFTA reports.

Streamline your fuel compliance process with Fleetio

At Fleetio, your success with IFTA reporting is important to us. In fact, we’re hard at work on a solution that would virtually eliminate all of the administrative headaches associated with obtaining quarterly fuel data for the jurisdictions you operate in.